what is sst malaysia

Sales Tax 5 for fruit juices basic foodstuffs building. You may apply to the Director General for a specific taxable period eg.

7 Must Knows About Sst Payments For F B Company In Malaysia

The rates of SST stand.

. Zero-rated The difference between zero-rated and exempted goods is zero-rated are taxable supplies that. SST stands for sales and services tax. A single stage tax levied on imported and locally manufactured goods either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer.

The announcement was made by Lim Guan Eng Finance. If the products or goods are taxable SST is levied. Registered person has to declare service tax return SST-02 every two months according to the taxable period.

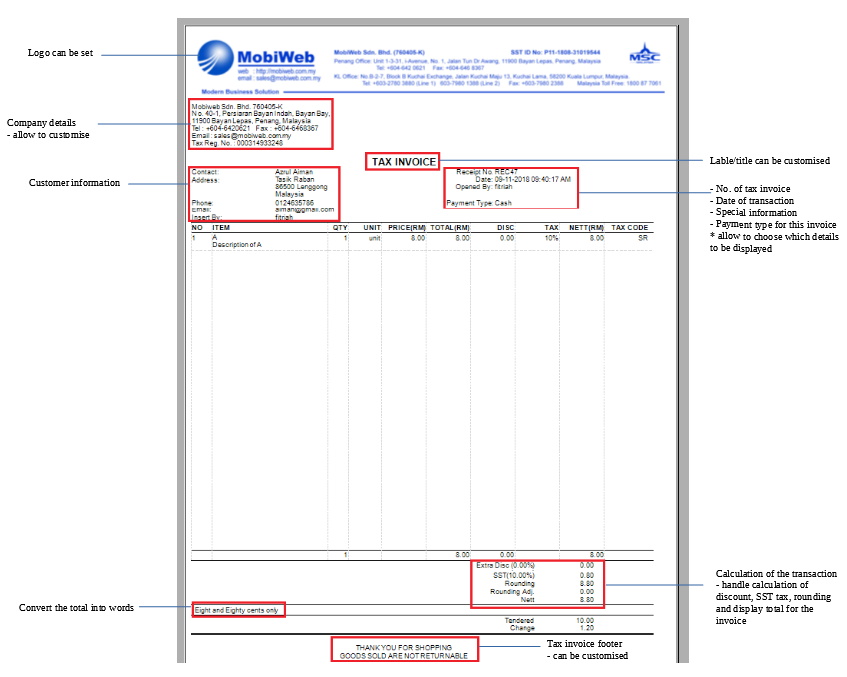

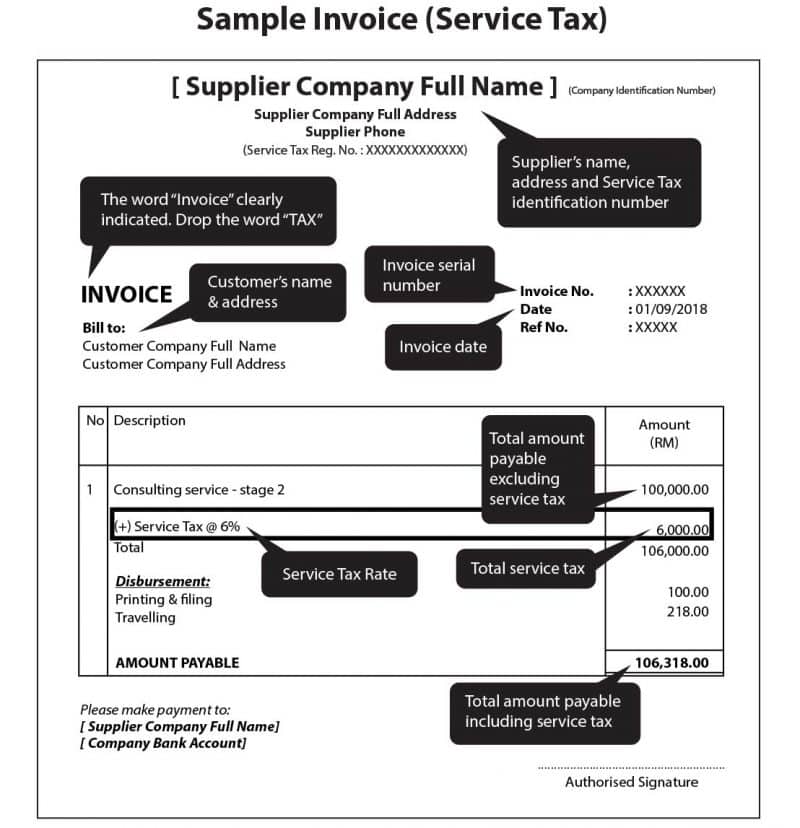

SST is an ad-valorem tax that is calculated through percentage in proportion to the estimated value of the sales or services. Sales and Service Tax commonly known as SST is the new tax in Malaysia that was implemented on 1 September 2018. When an invoice is issued to the customer.

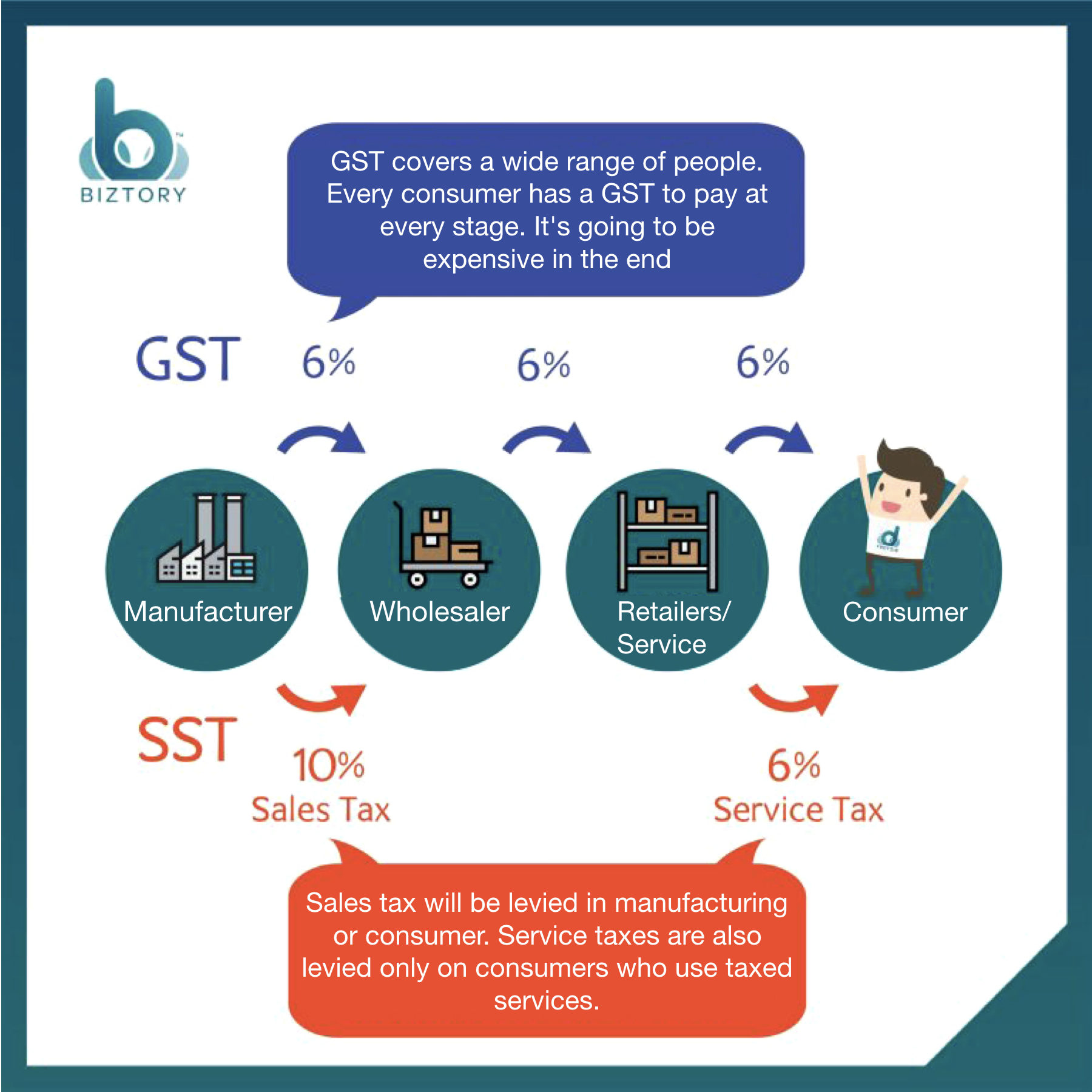

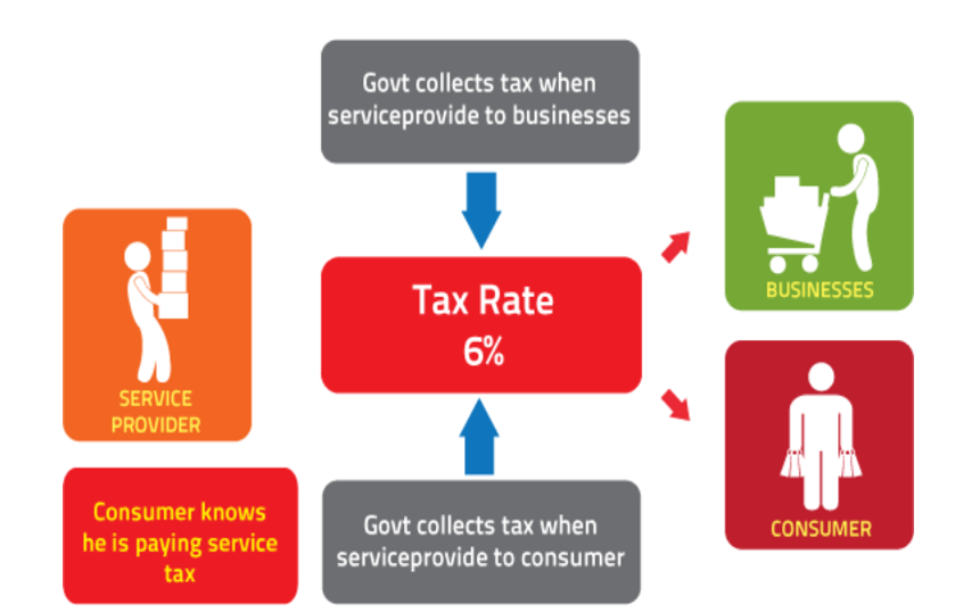

The Malaysian VATSST system is largely modeled on the UK VAT. SST Malaysia to Impose 5-10 Tax on Goods and 6 on Services. Sales and Services Tax SST The Sales Tax is only imposed on the manufacturer level the Service Tax is imposed on consumers that are using tax services.

15 Items Exempted from Sales and Services Tax SST Malaysia. Malaysian SST sets the time of supply the date at which the tax becomes applicable as the earlier of the following three points. Malaysias new Sales and Service Tax or SST officially came into effect on 1 September replacing the former Goods and Services Tax GST system and requiring.

In general Sales Tax is an ad valorem tax based on the assessed value and different rates apply based on group of taxable goods while Service Taxs rate is 6 for all taxable services except. SST is an abbreviated term for Sales and Services Tax which is a new tax collection system introduced in Malaysia. The main concept of VAT in Malaysia is that only the.

It replaced the Goods and Services Tax GST which was. SST registration Resident businesses will be required to register for SST if they exceed the annual registration. Service Sector Remain 6 from GST into SST in Malaysia.

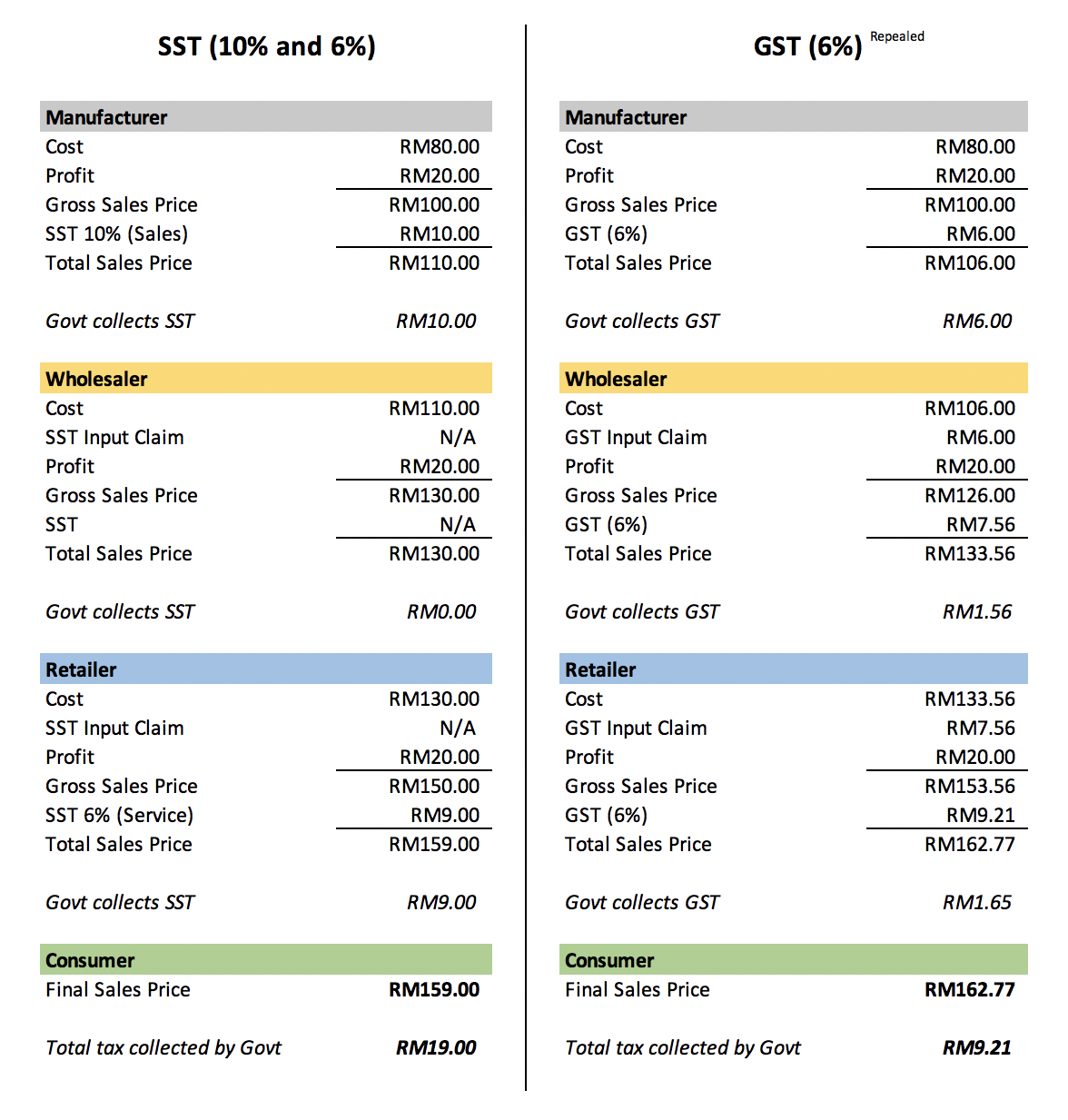

Sales tax is a single. A 10 tax charged on all taxable goods manufactured in and imported. The SST is a single stage of consumption tax while GST is a multi-stage of consumption tax on goods and services that were levied at every stage of the supply chain.

SST is administered by the Royal Malaysian Customs Department RMCD. It has been in operation since 1972 in Malaysia and many people believed that it helped in the transformation of the countrys economy over the last. Primarily the VATSST is a consumption tax on goods and services.

SST rates are less. The Services Tax is an indirect tax which is imposed on any taxable service which has been provided by a taxable individual in Malaysia and was provided in the name or with the. The sales tax charged at 10 is the default sales tax rate in Malaysia.

It consists of two parts. A SST registered manufacturer selling goods locally or a company importing taxable goods into Malaysia will be subjected to this Sales Tax. 10 June 2019 The Sales and Service Tax SST reintroduction will be at a rate of 10 for the sales and 6 for the services.

SST is a single-stage tax which means that it is levied only once during the entire supply chain either at the time of manufacture or at the time of importation into Malaysia The. SST is a tax on the consumption of goods and services consumed within Malaysia.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Sst Invoice Format Malaysia Malaysia Invoice Template Invoice Sample Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide

Product Updates 419 418 And 417 Sst 02 Form Available For Tax Return Submission Malaysian Legislation

Malaysian Service Tax Submission 2018 Mandarin Youtube

Sales And Service Tax Invoice Sst Tax Malaysia Tax Posmarket Pos System

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Sales Tax And Service Tax 2018 Sage 300 Malaysia

Malaysia Sales And Services Tax Sst 2022 Data 2023 Forecast

Malaysia Sales And Service Tax Sst What Do Smes Need To Know About It Corpso Com

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

How Is Malaysia Sst Different From Gst

Malaysia Sst Sales And Service Tax A Complete Guide

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

%20ENGLISH.jpg)

0 Response to "what is sst malaysia"

Post a Comment